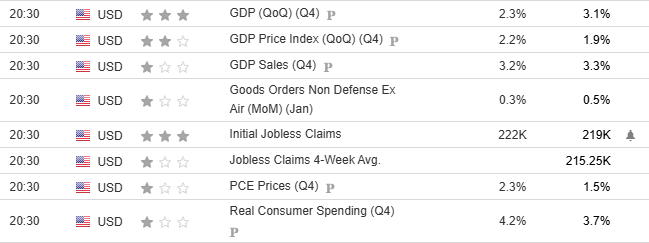

Many expected to have softened growth for the last quarter, anticipating an upward inflation problem. All are due to uncertainty in economic growth to tariffs related to geopolitical development, which will likely dampen investor sentiment.

Even if the growth meets the projected line or overshoot, this still does not mean that the US economy is in very healthy and balanced economic growth. Recent labor data are solid but do consider the recent layoffs from Trump and Elon Musk’s initiative. Expecting to have more investment pull in? have not come yet.

Inflation is flaring like crazy, and if the tariff threat does not fade away or the tariff agreement has not been reached on good terms, then we are likely to see more constraints on budget spending coming in leading to demand deterioration. And that is why the Federal Reserve is now standing side by side on hold for longer.

These two projected factors are already eye-soaring for the US economy. So imagine what could be a possible growth coming in where the main driver in growth is already heading toward a downturn.

Expecting to have trading partner’s economies help? Very Unlikely. The US economy could be stronger than most peers. Considering Canada’s economy, some already projected a stagflation scenario or what some called a “can’t growth economy,” despite heavy ease. The same as the UK’s economy, which is also seeking stimulus within. The EU and the US have now in a trade conflict recently. Japan is doing fine on its own but is also fighting an inflation battle with an expected tightening monetary policy as well. All of which are trying to fight against their own problems. Therefore, the US could be the only one that can save themselves, more or less. But I’m still looking forward to more policy changes from Trump.