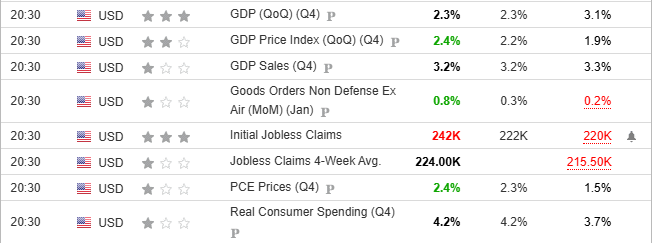

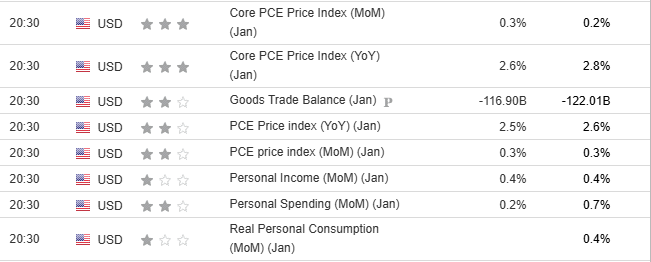

US inflation data tonight will give a rough idea of the direction of the disinflation progress, along with how the market did after hearing the tariff threat from the US’s president. Did they buy-front to get an advantage ahead of the tariff come or did they do nothing?

What we learned: Quarterly inflation surged higher than expected, giving the dooming idea that the Federal Reserve will remain faithful to holding the rate for longer. All come with higher egg prices to housing prices, and yet, a higher tariff is likely to continue fueling the inflation expectation.

Expectation: Despite this, most inflation data could probably come softer with major spending expected to reduce to 0.2% in January, as per analysts. Perhaps reluctant to purchase goods during uncertainty? But further clear insights will be shown through the report tonight.

Possible gold price reaction depends on various reasons. Yet if the inflation data heat up once again and lead the Federal Reserve to become hawkish, then this will likely weaken the gold price. If the cooling data come, then there will remain a positive message for the gold, albeit not much.

Other factors from Trump’s meeting tonight with Prime Minister of Ukraine will likely be a key highlight before the market closes.